New IRS Required Minimum Distribution (RMD) Tables: What You Need to Know

Table of Contents

- Beneficiary Ira Mandatory Distribution Table | Elcho Table

- Rmd Table 2018 Excel | Elcho Table

- inherited ira distribution table | Brokeasshome.com

- CHANGE TO IRA DISTRIBUTION RULES - Community Foundation of Northern ...

- inherited ira distribution table | Brokeasshome.com

- Ira Minimum Distribution Table 2017 | Review Home Decor

- Mandatory Ira Distribution Table | Elcho Table

- inherited ira distribution table | Brokeasshome.com

- Irs Ira Rmd Table 2018 | Elcho Table

- inherited ira distribution table | Brokeasshome.com

Understanding RMDs

New RMD Tables

The new RMD tables are as follows:

- The Uniform Lifetime Table has been updated to reflect longer life expectancies, resulting in lower RMDs for many retirees.

- The Joint and Last Survivor Table has also been updated, which is used for beneficiaries who are more than 10 years younger than the account owner.

- The Single Life Expectancy Table has been updated for beneficiaries who are not the spouse of the account owner.

Implications of the New RMD Tables

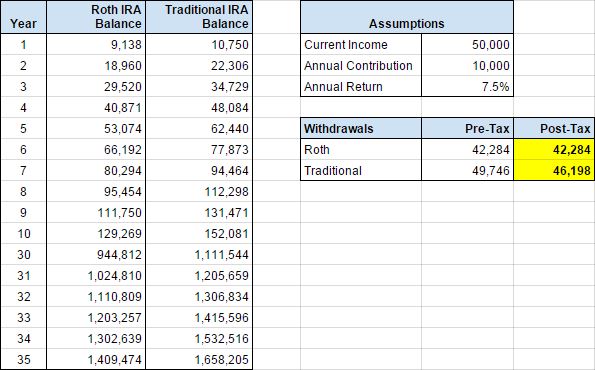

The new RMD tables will have several implications for retirees and beneficiaries:The lower RMDs will result in:

- Lower taxes: With lower RMDs, retirees will have to withdraw less money from their retirement accounts, resulting in lower taxes.

- More money in retirement accounts: The lower RMDs will allow retirees to keep more money in their retirement accounts, potentially resulting in more growth and higher balances over time.

- Increased flexibility: The new RMD tables will give retirees more flexibility in managing their retirement income and tax liability.

What You Need to Do

To comply with the new RMD regulations, you should:Review your retirement account balances and calculate your RMD using the new tables.

- Consult with a financial advisor or tax professional to ensure you are in compliance with the new regulations.

- Consider adjusting your retirement income strategy to take advantage of the lower RMDs.

- Review your beneficiary designations to ensure they are up to date and reflect your current wishes.