Understanding IRA Required Minimum Distributions for 2024-2025: A Comprehensive Guide

Table of Contents

- Required Minimum IRA Distributions | Welch Olsen LLP

- Inherited Ira Distribution Table 1 | Brokeasshome.com

- What are Required Minimum Distributions (RMDs)?

- Ready to Retire - Really!: November 2015

- Ready to Retire - Really!: November 2015

- The IRA Distribution Table: 3 Must-Know Tips | The Motley Fool

- Irs Mandatory Ira Distribution Table | Elcho Table

- Beneficiary Ira Rmd Distribution Table | Elcho Table

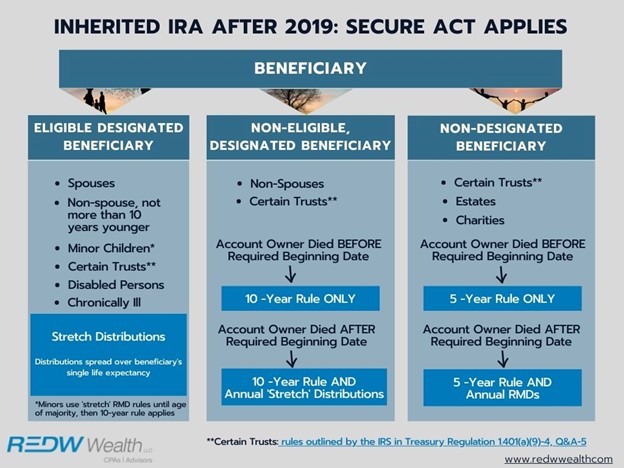

- Inherited IRA Required Distributions | REDW Financial Advisors & CPAs

- Required IRA distributions - Clark Howard Community

What are Required Minimum Distributions (RMDs)?

/https://blogs-images.forbes.com/baldwin/files/2014/03/rmd_own_larger.png?resize=618%2C635&ssl=1)

IRA Required Minimum Distributions Table 2024-2025

Key Takeaways

The IRA required minimum distributions table for 2024-2025 is based on the IRS's Uniform Lifetime Table. The RMD is calculated by dividing the account balance by the distribution period. Failure to take the RMD can result in a 25% penalty on the amount not withdrawn. RMDs are subject to income tax, but they can be reinvested or used for living expenses. Understanding the IRA required minimum distributions table for 2024-2025 is crucial for individuals with traditional IRAs, SEP IRAs, or SIMPLE IRAs. By following the guidelines outlined in this article and using the table provided by Bankrate, you can ensure compliance with the IRS regulations and avoid penalties. Remember to consult with a financial advisor or tax professional to determine the best course of action for your specific situation.For more information on IRA required minimum distributions and other retirement planning topics, visit Bankrate. Stay informed and take control of your retirement savings today!