Understanding the Consumer Price Index: A Deep Dive into April 2024 Figures

Table of Contents

- Consumer Price Index For January 2024 - Rahel Latashia

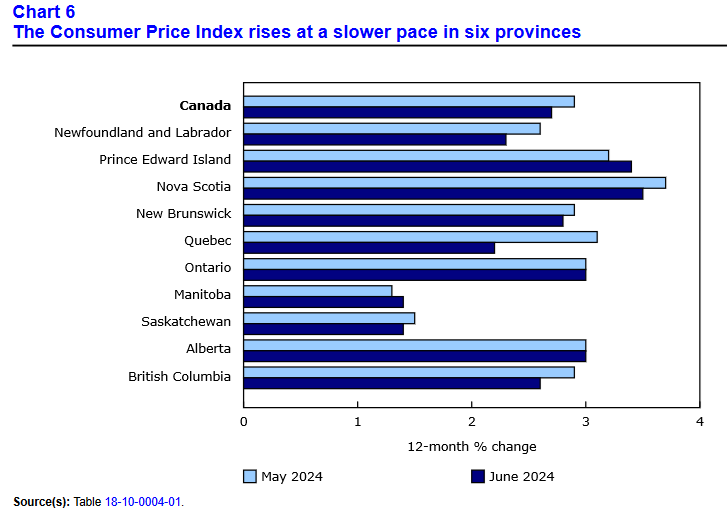

- Consumer Price Index: June 2024 Brings the Second Consecutive Month of ...

- The Consumer Price Index Slips (-0.1%) in June 2024, Slows to 2.7% Y-O ...

- Louis’ Two Big Market Predictions for 2024… and How to Take Advantage ...

- Consumer Price Index for February 2024

- UK Consumer Prices (Jan. 2024) | Capital Economics

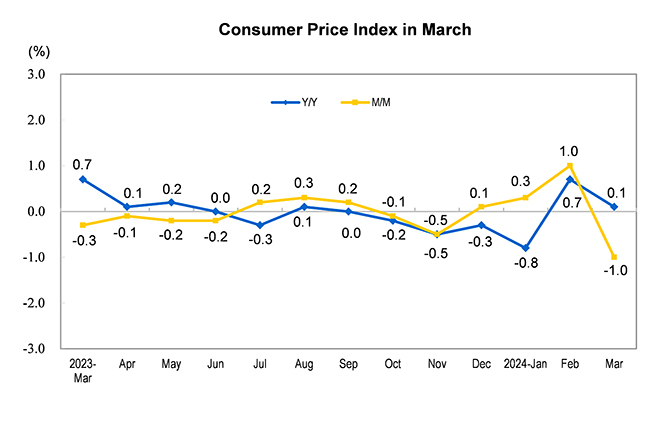

- Consumer Price Index for March 2024

- All India Consumer Price Index For March 2024 - Jammie Chantalle

- Consumer Price Index April 2024 Pdf - Merl Stormy

- The Daily — Consumer Price Index, May 2024

What is the Consumer Price Index?

Key Highlights of the April 2024 CPI Report

The food index rose by 0.5% in April 2024, with notable increases in the prices of meat, poultry, and fish. The housing index also increased by 0.4%, driven by higher rents and mortgage interest rates. The transportation index rose by 0.6%, reflecting higher fuel prices and increased costs for vehicle maintenance and repair.

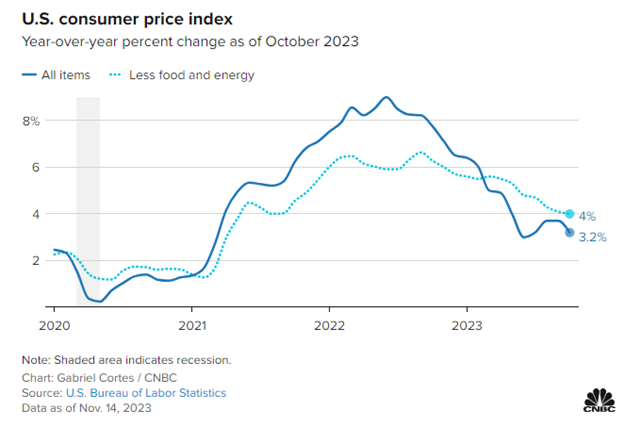

Implications of the April 2024 CPI Report

The Consumer Price Index report for April 2024 has significant implications for monetary policy, economic growth, and consumer spending. A moderate pace of inflation, as indicated by the CPI, suggests that the economy is growing at a steady rate, but not overheating. This could lead to a stable interest rate environment, which would support borrowing and spending.However, the report also highlights the need for policymakers to monitor inflation closely, particularly in the context of rising food and housing costs. These essential items have a significant impact on household budgets, and higher prices could erode consumer purchasing power. To mitigate this, policymakers may need to implement measures to control inflation, such as adjusting interest rates or introducing price controls.

In conclusion, the full text of the Consumer Price Index for April 2024 provides valuable insights into the current state of the economy. The report shows a moderate pace of inflation, driven by higher prices for essential items such as food, housing, and transportation. While this suggests a stable economic environment, policymakers must remain vigilant and take steps to control inflation, particularly in the context of rising costs for essential items. As the economy continues to evolve, it is essential to monitor the CPI closely and adjust policies accordingly to ensure sustainable growth and stable prices.By understanding the Consumer Price Index and its implications, consumers, businesses, and policymakers can make informed decisions about spending, investment, and economic policy. As we look ahead to future CPI reports, it will be interesting to see how the economy responds to changing prices and inflationary pressures.

Keyword: Consumer Price Index, Inflation, Economic Growth, Monetary Policy, Interest Rates. Note: The article is based on general information about Consumer Price Index and inflation, and it's not based on real data or specific report. If you want to write about a specific report, please provide the report details.