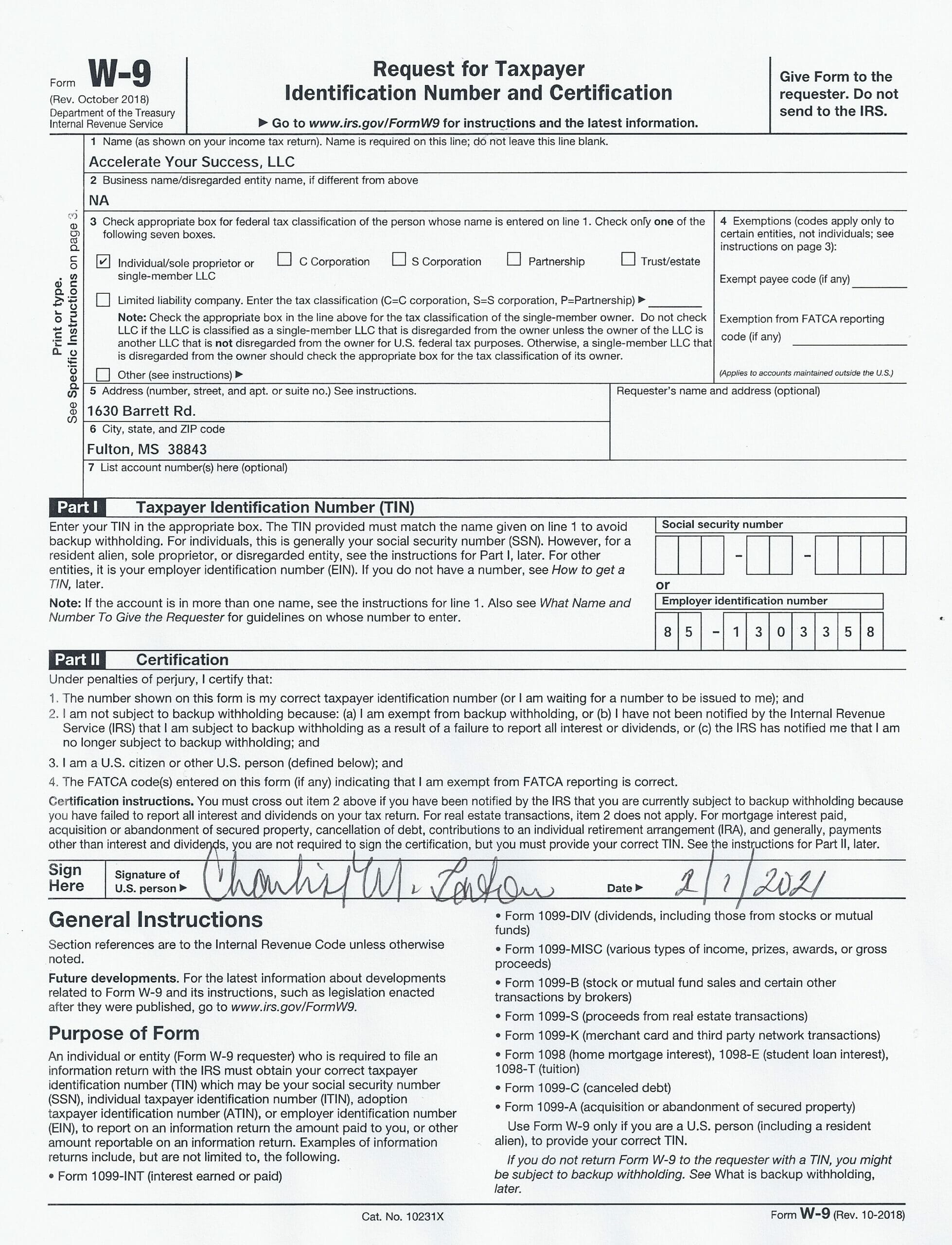

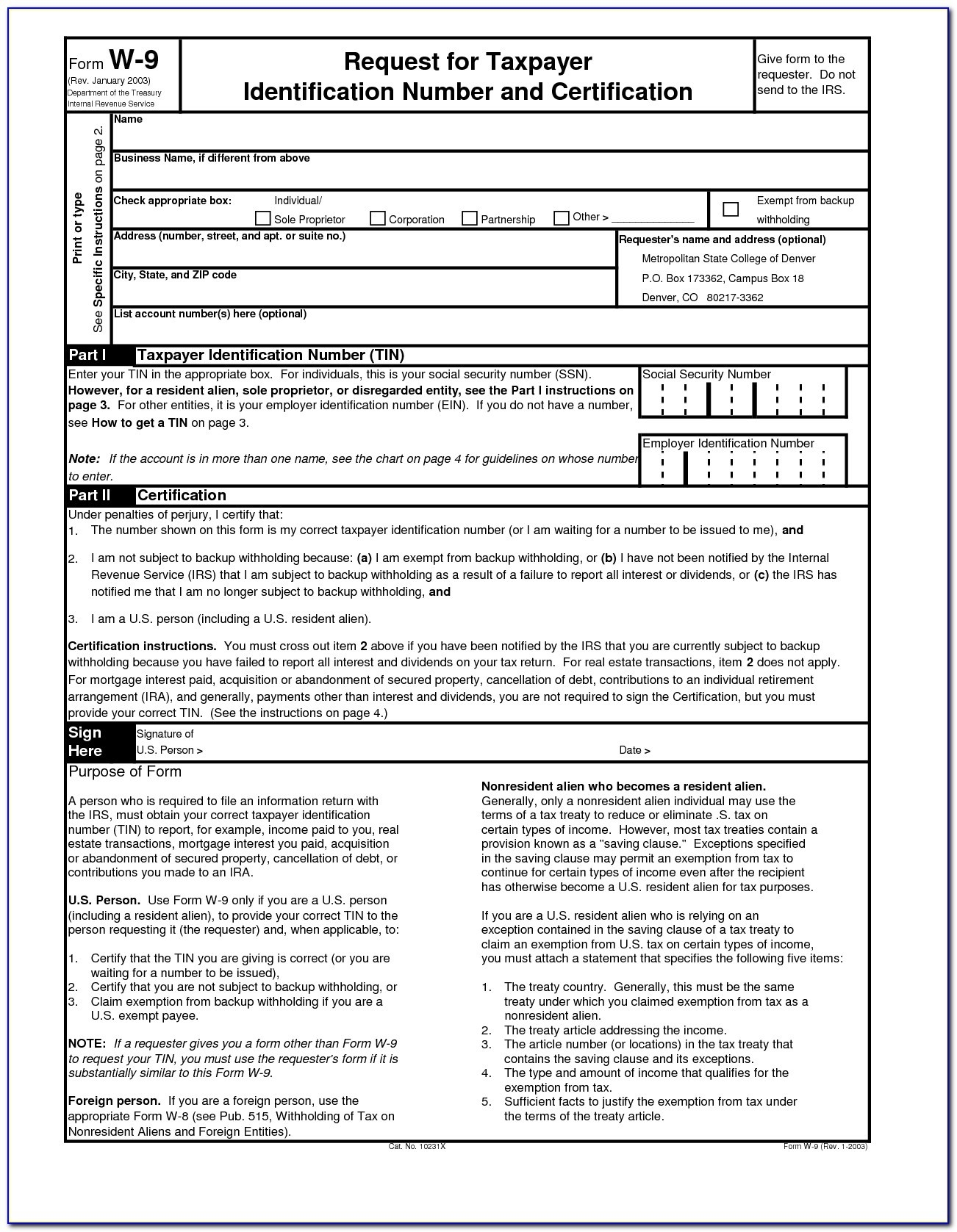

When it comes to tax compliance, one of the most crucial forms for businesses and individuals to understand is the

PDF Form W-9, available at

www.irs.gov/FormW9. The Internal Revenue Service (IRS) requires this form to be completed by independent contractors, freelancers, and vendors to provide their taxpayer identification number (TIN) and certification. In this article, we will delve into the significance of Form W-9, its purpose, and how to obtain and fill it out correctly.

What is Form W-9?

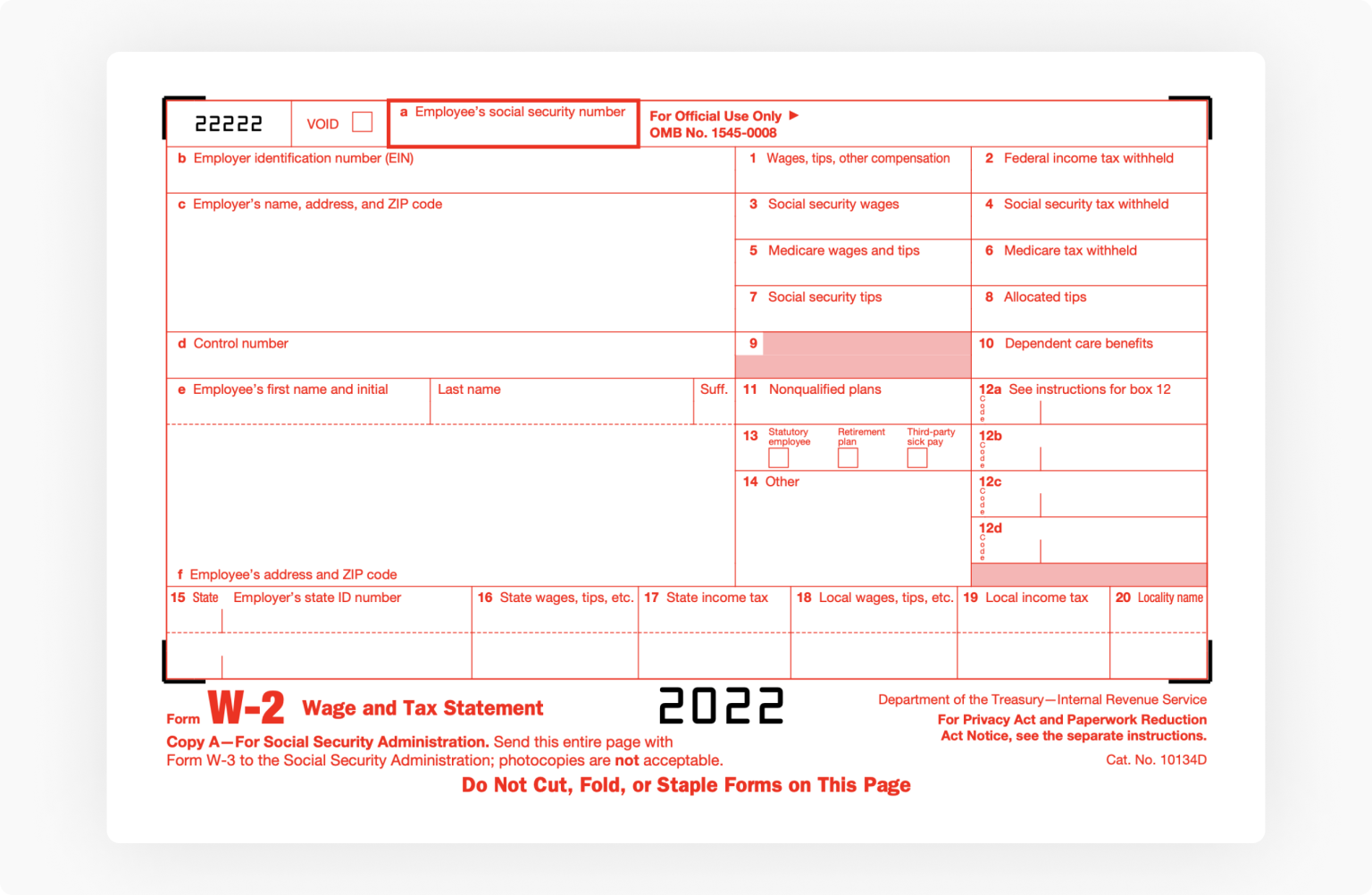

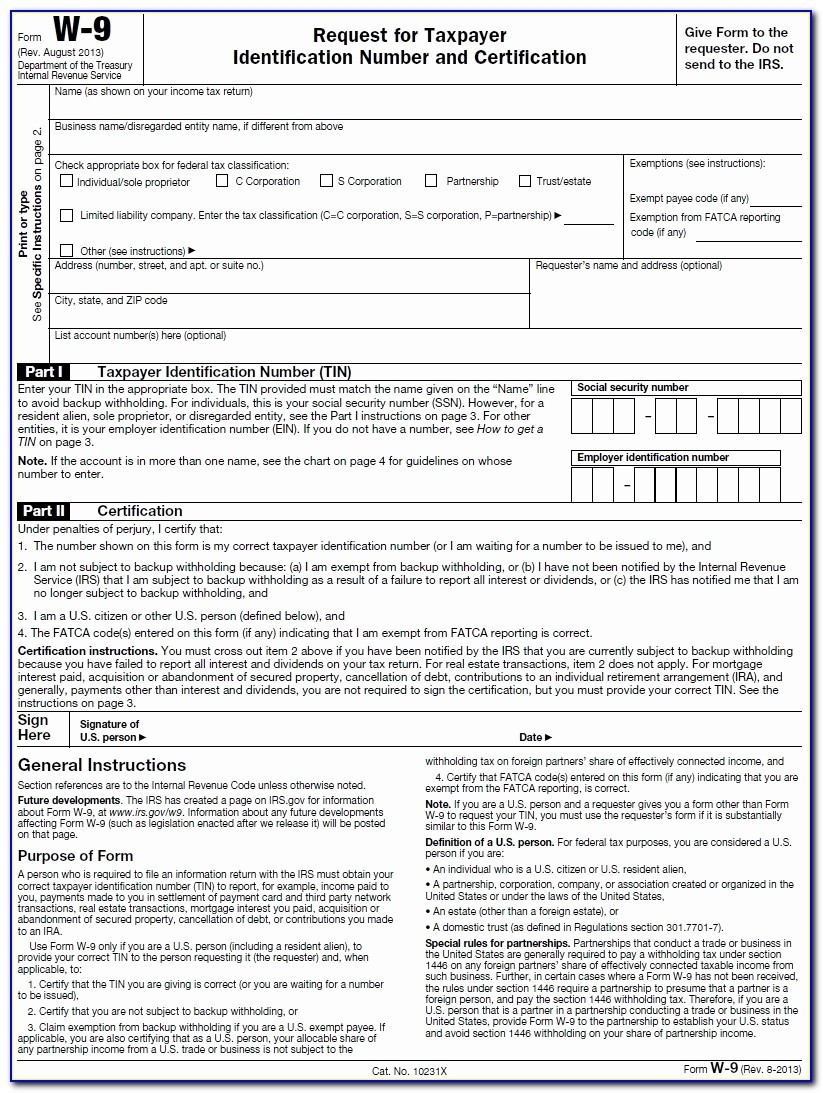

Form W-9, also known as the Request for Taxpayer Identification Number and Certification, is a document used by the IRS to collect taxpayer identification information from individuals and businesses. The form is typically required when a business hires an independent contractor or freelancer to perform services, and it is used to verify the contractor's identity and tax status. The information provided on Form W-9 is used to generate a 1099-MISC form, which reports the income earned by the contractor.

Why is Form W-9 Important?

Form W-9 is essential for several reasons:

Tax Compliance: The form ensures that businesses comply with tax laws and regulations, reducing the risk of penalties and fines.

Identity Verification: Form W-9 helps verify the identity of independent contractors and freelancers, reducing the risk of identity theft and fraud.

Accurate Reporting: The form provides accurate information for generating 1099-MISC forms, ensuring that contractors receive correct tax documentation.

How to Obtain and Fill Out Form W-9

To obtain Form W-9, visit the IRS website at

www.irs.gov/FormW9 and download the

PDF version. The form can be filled out electronically or manually. When filling out the form, ensure that you provide accurate and complete information, including:

Name and Business Name

Address

Taxpayer Identification Number (TIN)

Tax Classification

It is crucial to review the form carefully before submitting it to ensure that all information is accurate and complete.

In conclusion, Form W-9 is a critical document for businesses and individuals to understand and complete accurately. By visiting

www.irs.gov/FormW9 and downloading the

PDF version, you can ensure compliance with tax laws and regulations. Remember to fill out the form carefully and provide accurate information to avoid any potential issues. If you have any questions or concerns, consult with a tax professional or the IRS directly.